Morgan Stanley Capital International (MSCI) indexes are one of the most globally followed benchmarks of the stock markets. They include more than 80 countries from developed, emerging and frontier markets, covering 99% of investable opportunities. Indexes are weighted by market cap and created following the Global Industry Classification Standard (GICS). Created in 1968 it represents […]

Purchasing Managers Index (PMI) is the leading indicator of the economic growth and directions of the economic trends. It is derived from the survey of private businesses in specific sectors. The index is published monthly and observed by various market participants. The Institute for Supply Management (ISM) publishes the indexes for the US, interviewing 400 companies in […]

Risk reversal is an options trading strategy used to hedge risk. The strategy protects against adverse movements but at the same time limits potential profit. A trader buys one option and other write depending on a position in underlying. Income from the written option can outweigh the premium paid for buying one. Long risk reversal […]

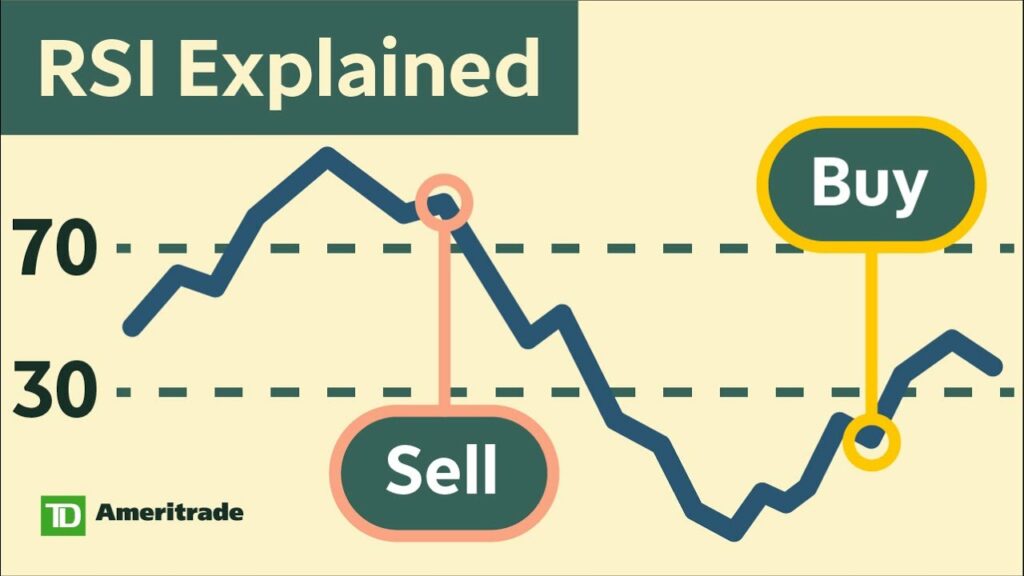

The Relative Strength Index was developed by J. Welles Wilder Jr. and introduced in his book, New Concepts in Technical Trading Systems in 1978. He described and interpreted the indicator and later the work of Brown and Cardwell developed new interpretations and concepts using the RSI indicator. Even dating back to 1978 the indicator proved […]

In the aftermath of the Great 1929 stock market crash, the US government passed the Securities Act of 1933 and the Securities Exchange Act of 1934, which created the Security and Exchange Commission (SEC) with the aim to restore investor confidence in the capital markets. The SEC mission is to protect investors, to maintain fair […]

Contractionary monetary policy is the set of policies conducted by central banks aiming to curb inflation and slow overheated economic growth. Through its instruments the central bank tries to halt the overall rise of prices in the economy and decrease the supply of money. It restricts or tightens the access to money making it too […]

VIX index was created by Chicago Board Options Exchange (CBOE) in order to provide a measure of stock markets expected volatility in 30-day period. It is also known as fear index or fear gauge. It is calculated using implied volatility of SP500 options. Thus, the index is forward looking as it measures expected volatility in […]

Fractals are one of the indicators used in identifying trend reversals. Namely, fractals represent one of the simplest trade patterns, repeating over time. At least five bars in a bar chart are needed to form a pattern. Fractal can be bearish or resistance, indicating downtrend will be following/ bullish or supportive fractal tells us the […]

The Economic and Monetary Union (EMU) was set up in 1992 when twelve countries signed the Maastricht Treaty (The Treaty on European Union). It was one of the main steps in further integration of EU countries aiming to provide joint coordination of economic and fiscal policies, a common monetary policy, and a common currency, the […]

The US Dollar Index (USDX, DXY, DX) represents the value of US Dollar against the basket of foreign currencies. The index is a weighted geometric mean of dollar value against following currencies: The currencies represent the most important US trading partners. The index structure changed only once when euro came instead of many European currencies in 1999, […]